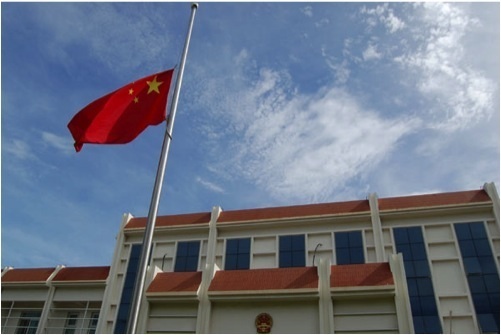

Above: the Chinese embassy in Kingston

By Alexander Britell

China’s involvement – and influence – in the Caribbean region has grown rapidly over the last several years – from the construction of new national sports stadiums to large-scale infrastructure projects. It’s even drawn other players into the region – most recently, South Korea. But just how much impact has China had on the Caribbean’s economy? According to a recent World Bank report, the number is not as high as it might seem. To learn more, Caribbean Journal talked to Dr Auguste Kouame, the World Bank’s Lead Caribbean Economist, about China’s impact in the region, what the Caribbean can in fact learn from Japan and the future of Chinese-Caribbean trade.

How would you describe China’s interaction with the Caribbean?

Well, as you know, China’s interaction with the Caribbean is very limited, compared to the rest of Latin America. In a previous report, we did an analysis showing that Latin America was more connected [with China] than the Caribbean, and the Caribbean had very little trading with China. The analysis showed that the economic cycle in the Caribbean is disconnected with the economic cycle in China, while the economic cycle in China is more connected or coordinated with the economic cycle in some of the Latin American countries. So the short answer is that China’s economic involvement with the Caribbean is essentially nonexistent.

China has been involved in other ways – from building stadiums in the Caribbean to working on infrastructure projects. How would you describe this involvement?

The involvement with Caribbean projects is on the political or public sector side, where the Chinese government gives a loan, or the Import-Export bank provides some loans – those are in the public sector. The involvement that really matters for the economic cycle is more in the private sector side, and this is the part that is not there. There is no trade – no remittance flows, virtually no foreign direct investment. That’s the kind of connection that matters for the coordination of the economic cycle and for growth, and also for the transfer of knowledge and technology. The transfer of technology side is not automatic either – even when there is coordination of cycles and trade, there is not necessarily a transfer of knowledge.

How could China interact with the Caribbean economy?

I think this is a bit controversial, but on the infrastructure side, I think China could play a role, but as a private investor. Because many Caribbean countries will want to limit the government’s expenditure on large infrastructure, because they simply cannot afford it. And they will be looking for private investors, to enter public/private partnership arrangements with them, so the government provides some contribution. But the private sector would contribute the largest part of the infrastructure project. And Chinese investors – not necessarily the Chinese government – could become potential partners in those projects, because the corporate sectors and private sectors in mature economies like the US or UK or European countries that could have played that role are having their own problems. Jamaican investors or Trinidadian investors could play that role, but they’re limited in what they can do. So I think attracting private investors from China for large infrastructure projects could be a way to go, and attracting private investors for pure private investment in manufacturing, and the service industry, could be another way to go. There might be the possibility of interesting Chinese investors in the services industry, especially the health sector. Tourism is a natural place, but health tourism could be an area that the Caribbean countries could develop further and Chinese investors could play a role. And when China invests, it could also generate opportunities for attracting tourists from China, or medical tourists from China.

The report looks at the situation of Japan’s interaction with the East Asian tigers in the 1990s. What are the lessons for the Caribbean from that interaction?

Well, the lesson that we talk about in the report is that for the East Asian tigers, Japan acted as a magnet for investment, as well as for knowledge. The East Asian countries trading with Japan learned a lot through knowledge transfer, they learned a lot through investing in human capital to allow them to understand technology from Japan and replicate it and adapt it, and many of them did very well. The lesson that it has for Latin America in general is that trade with China is not sufficient – you need to get knowledge from it. But the bad news is that China’s transfer of knowledge is not as great as Japan’s technical advantage [at the time]. So maybe all China can offer is trade flows without knowledge flows. For the Caribbean, it means if the Caribbean wants to develop the kind of trade and economic connections with China that the rest of Latin America has, a lot of thought should be put into what knowledge would come with it. Because the economic connection, in and of itself, doesn’t take you very far. It’s good to have it, but it doesn’t make you a very high growth economy, like we saw in East Asia with the Tigers. I think if the Caribbean tries to develop economic connections with China, there need to be specific sectors to target. If Trinidad were to develop ties with China, don’t just sell gas or oil, but develop ties in areas where there is a high knowledge component, so that through trade you can learn technology. If the Caribbean were to attract Chinese tourists, don’t just attract Chinese tourists, attract Chinese tourists in combination with health tourism, for example. So that tourists don’t just come and enjoy the beach and go, but also when they come, they use medical facilities, and that could encourage high-tech Chinese medical technology to come in and invest in the Caribbean.

What do you see happening for the China-Caribbean economic connection going forward?

I see changes. I think things will change – because the Caribbean traditionally has relied on its connections with the US and the UK and Europe to generate economic growth – externally driven growth. The Caribbean is a very open economic area, where the economies are very open, but the openness is largely driven by the US, UK and Europe. And as we all know, the US, UK and Europe are not seeing the most dynamic growth at the moment, and may not become dynamic for a long time. On the other hand, we know that China and other BRIC countries are becoming increasingly important. For the Caribbean, if you maintain your connection with countries that aren’t growing, you may not grow as much. So the pressure to connect with China will grow, and it’s here to stay. So I see the relationship between China and the Caribbean changing. How will that relationship be structured? It remains to be seen. I think that the Caribbean should play a very proactive role in defining the relationship and the nature of the relationship. Because China, in developing relationships, always tries to pursue its own economic interest, and that may, every now and then, come into conflict with the Caribbean’s economic interest. So the Caribbean will have to take a very proactive role.

Bahamas, China Sign Abaco Contract