By Paul Hay

CJ Contributor

“With the widening of the Panama Canal and construction of a second canal in Nicaragua, a significant increase in trade and investment can be expected in the Caribbean Basin. So, improving competitiveness of local firms is imperative and this through the improved competiveness of Greater Caribbean states”.

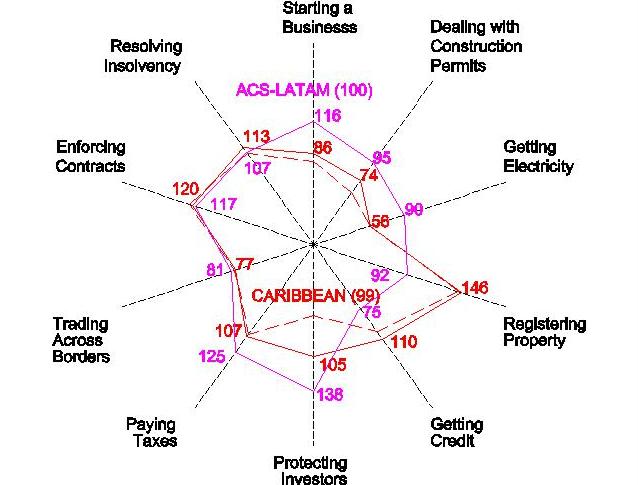

In “Why Caribbean Business Needs Reform”, I noted that “9 of the top 12 highest ranked economies” in the Latin America and the Caribbean (LAC) region are located in the Greater Caribbean; as are “3 of the lowest ranked economies in LAC”.

“LAC is one of the regions ‘with the smallest share of economies implementing regulatory reforms as captured by Doing Business’ and the Greater Caribbean not only has the most capable states to effect this reform, but also the most deserving of states for reform”.

In this article, I examine the status of Greater Caribbean States in “Doing Business 2015: Going Beyond Efficiency”, particularly with regard to the respective performance indicators, and suggest a way forward. The states considered and their overall ranks are as follows:

The Greater Caribbean region is ranked 99, out of the 189 nations examined in “Doing Business 2015”. It should therefore be noted that 7 out of the 12 Latin American states are below this rank; as well as 6 out of the 13 Caribbean Island states.

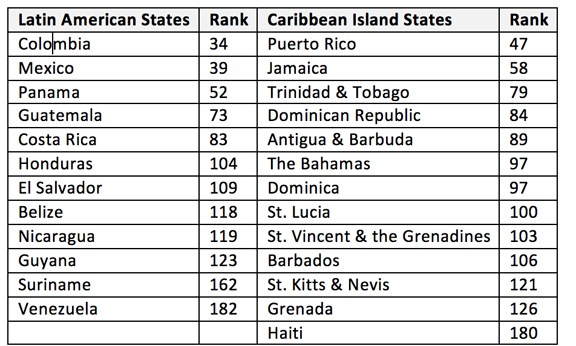

The overall ranks are determined from evaluation across 10 performance indicators, representing the 4 stages of the business cycle: namely, start-up, operation, expansion and insolvency. Figure 1 maps the performance of the Greater Caribbean region with regard to each of these indicators.

Figure 1: Global Competitiveness Map of the Greater Caribbean

The points closer to the centre of the map represent indicators having better performance. The circle in dashed line represents the average rank of the region. So, points within the circle are indicators which have better-than-average rankings, and vice versa.

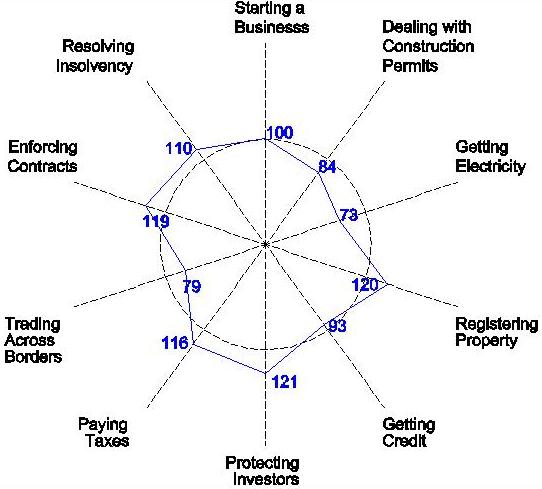

Figure 2 maps the competitiveness of the Latin American (LatAm) versus Caribbean Island States. Three curves are illustrated: the LatAm States of the Association of Caribbean States (ACS) in magenta, and two curves in red denoting the Caribbean Islands.

Figure 2: Global Competitiveness Map – Latin American vs. Caribbean Island States

Curve in the solid red line maps the competitiveness of the Caribbean Islands in “Doing Business 2015” and curve in the dashed red line maps their competitiveness in “Doing Business 2014”. A comparison of both these curves indicates the global deterioration of the islands’ competitiveness within the year.

“Enforcing Contracts” improved marginally from 123 to 120. Otherwise, there was a general deterioration in the rankings across the remaining 9 out of 10 indicators shown. This is an indictment against the islands for failing to effect reform necessary to improve their standing.

In “Jamaica Takes the Leap in Doing Business Indicators: 5 lessons for the Wider Caribbean”, author Navita Anganu-Ramroop further emphasises that “… the competitiveness of nations are equally important and necessary for the competitiveness of firms operating within the country”.

Currently, the average overall rating for the islands is 99: the same as that of the Greater Caribbean. The average overall rating for the LatAm states is marginally worse at 100. The Greater Caribbean rank is better because there is one more island in this grouping. But, the difference is really negligible.

In comparing the current ratings for both sub-regions across the indicators shown in figure 2, it is obvious that the ratings are similar for 3 indicators: “Resolving Insolvency”, “Enforcing Contracts”, and “Trading Across Borders”. Otherwise, differences in ranking vary from 18 to 54 ranks.

The former 2 indicators have worse-than-average ratings. Both sub-regions also had worse-than-average ratings for 2 other indicators: “Paying Taxes” and “Protecting Minority Investors”, though the differences were marked in the latter. Only “Trading Across Borders” had a better-than-average rating.

But, both sub-regions also had better-than-average ratings for 2 other indicators: “Getting Electricity” and “Dealing with Construction Permits”. This means that the curve of figure 1 is representative of sub-regional ranks across these 7 indicators: 3 better-than-average and 4 worse-than-average.

Later analysis will show that the highest ranked states in the Greater Caribbean are actually similar about 2 of these 3 remaining indicators: namely, “Starting a Business” and “Getting Credit”. But, there is a distinct difference in “Registering Property”.

These remaining indicators typically had one sub-region having worse-than-average rating while the other sub-region had better-than-average. For “Starting a Business”, the Greater Caribbean rating is actually border-line. But, LatAm ranked worse-than-average, while the islands better-than-average.

Conversely, the islands had worse-than-average ratings in the 2 remaining indicators: “Getting Credit”, and “Registering Property”. But, LatAm states had better-than-average ratings. The ratings shown in figure 1 therefore represent LatAm in the first instance and the islands in the second.

While most will readily appreciate the importance of “Starting a Business” and “Getting Credit” in doing business, “the significance of ‘Registering Property’ should not be underestimated”. Without this, owners cannot generate capital from their property.

Peruvian social scientist Hernando DeSoto states that 80 per cent of the World is under-capitalised because of this. Using Haiti as an example, he explained that the total assets held by its poor amount to over 150 times all foreign investment made in that nation since its independence in 1804.

There is an opportunity for respective sub-regions to improve their ranks in these 3 target indicators through collaboration. LatAm states can assist the islands to improve their ranks in “Getting Credit”, and “Registering Property”; while the islands could reciprocate with regard to “Starting a Business”.

There are 5 champion economies for “Starting a Business”. These economies and their respective ranks in parenthesis, shown in descending rank, are: Jamaica [20], Panama [38], Puerto Rico [48], Dominica [63], and Mexico [67].

Similarly, there are 5 champion economies for ‘Registering Property’ but none are islands. ”. These economies and their respective ranks in parenthesis, shown in descending rank, are: Columbia [42], Costa Rica [47], El Salvador [56], Panama [61], and Guatemala [65].

There are 7 champion economies for Getting Credit”. These economies and their respective ranks in parenthesis, shown in descending rank, are: Columbia [2], Honduras [7], Puerto Rico [7], Guatemala [12], Jamaica [12], Mexico [12], and Panama [17].

Considering the 4 previous worse-than-average indicators, LatAm therefore has 5 below-average indicators in total, and the islands have 6. The worse of all is “Enforcing Contracts” where only Mexico has a rank better than 70. International assistance is therefore required to address this.

There are only 3 champion economies for “Paying Taxes”. These economies and their respective ranks in parenthesis, shown in descending rank, are: Antigua [31], Guatemala [54], and Belize [61].

There are 4 champion economies for “Protecting Minority Investors”. These economies and their respective ranks in parenthesis, shown in descending rank, are: Columbia [10], Antigua [35], Mexico [62], and Trinidad and Tobago [62].

Finally, there are 5 champion economies for Resolving Insolvency”, and all are islands. These economies and their respective ranks in parenthesis, shown in descending rank, are: Puerto Rico [7], Barbados [26], Jamaica [59], The Bahamas [60], and Trinidad and Tobago [66].

Besides “Enforcing Contracts”, the Greater Caribbean can collaborate to improve its performance in “Doing Business” indicators. In all, there are 15 champion economies for the 25 states; and, with the exception of Mexico, none is champion over more than 3 indicators.

Understandably, the 6 states which are champion economies in 3 or more indicators also have the highest overall ranks: namely, Columbia, Mexico, Puerto Rico, Panama, Jamaica, and Guatemala. But, they are also champion economies in the 3 indicators otherwise deemed “atypical” of the sub-regions.

All are champion economies in “Getting Credit”. Mexico, Puerto Rico, and Jamaica are champion economies in “Starting a Business”; while Panama is champion economy in all 3. Columbia and Guatemala are champions in “Registering Property”, for which there is no island champion.

This selection of target “Doing Business” indicators and their respective “champion economies” to provide capacity building assistance to needy states is actually the model used by the Asia Pacific Economic Cooperation [APEC].

Their “champion economies” are not only expected to share information and experience with the others, but also undertake personalized diagnostic studies. APEC also sets measurable targets with specific time-lines to facilitate the monitoring and evaluation of performance.

APEC’s 2009 “Doing Business” Action Plan, for example, sets the goal of making business 25 per cent cheaper, faster and easier by 2015; and, “… sustained engagement by top government officials from every APEC member is needed to accelerate progress towards the goals it has set for itself”.

According to “APEC: Sharing Goals and Experience” in Doing Business 2013: Smarter Regulations for Small and Medium-Sized Enterprises, there was already a marked improvement of APEC’s member states relative to its non-APEC contemporaries mid-way into this Action Plan.

So, “Other regional bodies can learn from this model of capacity building”, and ACS should take heed. Mexico is an APEC member-state that has proven to be one of the ACS’ and by extension the Greater Caribbean’s top performers. Other ACS states could likewise benefit.

ACS needs to implement APEC’s model to improve the regions’ global competitiveness. A concerted effort needs to be made by the regions’ top governmental officials in this regard. Otherwise, only a few states will benefit from future projected increase in trade and investment.

ACS needs to act with alacrity. Cuba, which is an ACS member-state that has not been evaluated in “Doing Business” but will likely see increased trade and investment due to normalization of relations with USA, also stands to gain from such regional collaboration.

It cannot be overemphasized that ultimately it is the local firms which operate within the Greater Caribbean that stand to gain the most. But, their respective governments need to act on their behalf and reform so that they can compete and succeed in the global market place.

Paul Hay, a Caribbean Journal contributor, is the founder and manager of Paul Hay Capital Projects.